Diamond Capital Management's Market Commentary

December, 2025

Darren Nyce, CFA

Vice President & Senior Portfolio Manager

Executive Summary:

|

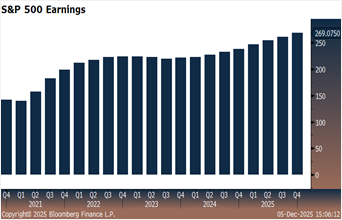

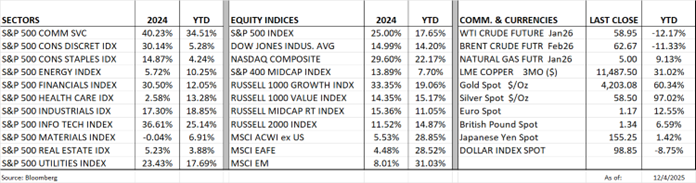

Despite enduring a 4% drawdown in November, the S&P 500 was able to rally and finished positive for the month, extending its consecutive gain streak to 7 months. This month’s returns did bring the unusual occurrence of technology being the worst performing sector while Healthcare took over the upward leadership. Equity markets are up over 17% for the year.

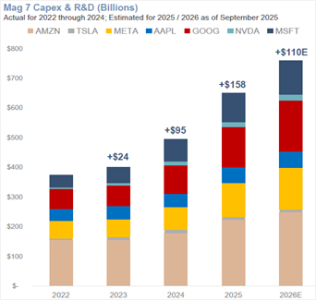

Part of the reason for November’s pullback and the rotation away from technology (even if only temporarily) is an underlying uncertainty about how well the massive investment in Artificial Intelligence (AI) will pay off. The amount of money that the “Magnificent 7” stocks have devoted to CapEx and R&D is staggering. During Q3 earnings calls, 62% of companies discussed AI adoption. The upside to AI is high, but for investors, so are the current valuations in this space. So far, earnings have kept pace; investors will be watching carefully to see if this remains the case.

After a drawn-out affair, the government shutdown came to an end. This may have dealt a hit to GDP as some productivity was certainly lost. One of the aftereffects is having to muddle through for a few months of incomplete and/or untimely economic data. For instance, the most recent inflation data only gives us the picture through the end of September. This provides a challenge for the Federal Reserve which is charged with balancing inflation and employment.

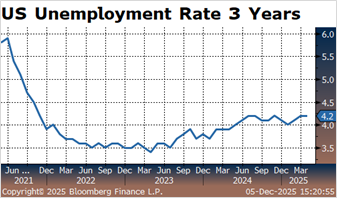

The labor situation is cooling but not necessarily cracking. We remain in a low hire, low fire environment. The crackdown on immigration seems to be weighing on growth but does not appear to be a large factor in the labor slowdown. The Fed appears to be willing to cut interest rates to encourage employment despite inflation hovering above their preferred levels.

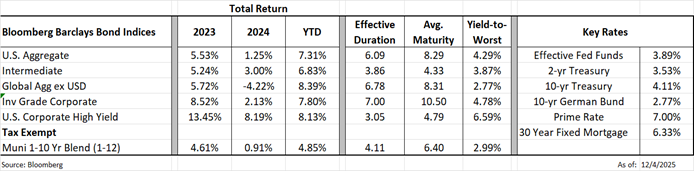

Bonds have also had a productive year posting solid returns. Credit spreads are tight, but the fundamentals are solid. Consumer spending has remained robust while debt remains stable. The combined data indicates that near-term recession risks remain low. We will vigilantly watch for changes to that picture.

Thanks for allowing us to be a part of your financial journey. Have a great Holiday Season!

|

|

The information and material contained herein is provided solely for general information purposes. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.