Diamond Capital Management's Market Commentary

February, 2026

Jeff C. Mantock, CFA, CMT

Vice President & Chief Investment Officer and Manager

Executive Summary:

- The U.S. economy is performing well, but there is “room for improvement.”

- Signs of improvement in underperforming sectors are taking place, and 2026 has multiple catalysts.

- The market is showing signs of healthy sector/factor rotation – consistent with economic expansion.

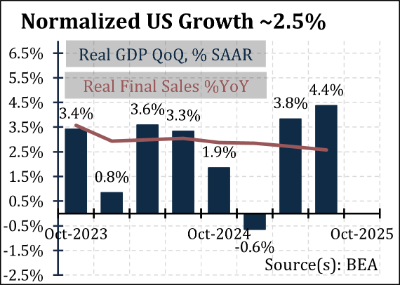

Real GDP grew at a 4.4% annualized rate in third quarter of 2025, and that appears to be a tremendous pace of growth. Many Wall Street analysts now argue that growth must inevitably decelerate from here. However, if you look under the hood, things aren’t as they appear.

Real GDP grew at a 4.4% annualized rate in third quarter of 2025, and that appears to be a tremendous pace of growth. Many Wall Street analysts now argue that growth must inevitably decelerate from here. However, if you look under the hood, things aren’t as they appear.

First, the most recent GDP print is distorted by significant accounting effects related to private inventory and trade flows. If we strip away these acyclical factors by looking at Real Final Sales to Private Domestic Purchasers, or even the New York Fed’s Weekly Economic Index, it becomes clear that the U.S. private sector is growing at a rate closer to 2.5% on a normalized basis.

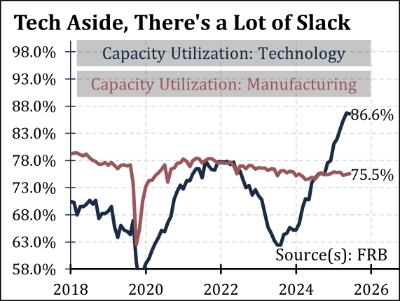

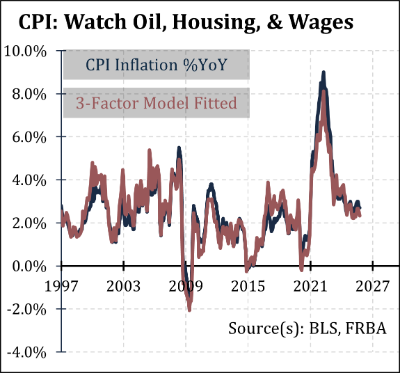

To be clear, that represents a robust level of growth for a mature economy like that of the U.S., but the level belies a certain narrowness. Capex related to technology and artificial intelligence has boomed, contributing 30-40 basis points/quarter for the last year. Meanwhile, other areas of the economy have lagged: the labor market has softened, the housing sector remains stagnant, and manufacturing capacity utlization sits meaningfully below potential.

In our view, this dynamic is likely to change in 2026. While we expect AI-related investment to continue growing, its pace of acceleration is expected to moderate. At the same time, interest-rate relief and the broad fiscal stimulus embedded in the “One Big Beautiful Bill” should induce improvement in growth conditions outside of technology.

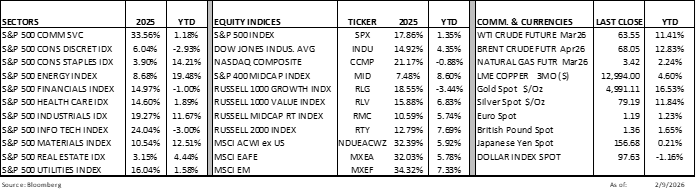

Markets appear to be anticipating this change. While many investors may not have noticed, the Nasdaq 100 peaked on October 29th. Meanwhile, the Russell 2000, the equal-weight S&P 500 Index, and the S&P Regional Bank Select Index have gone on to make new highs.

That shift is not a cause for concern; rather, it reflects the classic late-cycle broadening. As Ralph Acampora famously noted, “Sector rotation is the lifeblood of bull markets.” It does, however, call for careful portfolio positioning and an active approach to risk management.

The information and material contained herein is provided solely for general information purposes. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.