Diamond Capital Management's Market Commentary

July, 2025

Jeff C. Mantock, CFA, CMT

Vice President, Chief Investment Officer & Manager

Executive Summary:

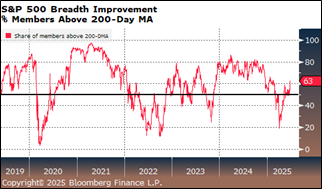

- Stocks extended their rally into July! The S&P 500 Index is up 26% since its lowest close in April. More than half of the Index’s members have prices above their 200-day moving averages.

- The FOMC meets again at the end of the month. They are expected to keep the federal funds target rate unchanged until September at the earliest.

- We expect the short end of the yield curve to stay inverted in the near term. Longer-term Treasuries are likely to remain range-bound but sensitive to inflation data and Fed signals.

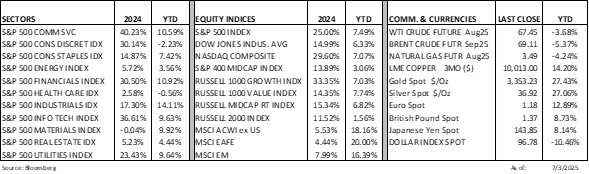

The rally in stocks has extended through the first week of July! The S&P 500 Index ended the first half in positive territory and has earned 7.49% YTD. What is exceptional is how quickly stocks recovered from a sharp decline just a few months ago. The S&P 500 Index approached bear-market territory before rebounding more than 26% from its lowest close on April 8th and finishing Q2 up 10.94%. Breadth improved as well with the stock prices of more half of the S&P 500 Index’s members rising back above their 200-day moving averages—evidence that participation in the rebound has not been limited to only a few names or sectors.

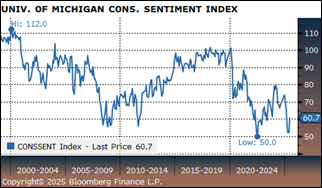

Investors have become less concerned about near-term global risks in recent weeks. Inflationary fears have been eclipsed by steadfast consumer spending and reliable corporate profits. Accordingly, consumer sentiment hit a four-month high in June, and the volatility that shook the markets just weeks ago has now faded. Yield spreads on high-yield bonds have also narrowed substantially—signaling that worries have subsided for now. Nevertheless, investors should expect to wait a while longer before the Fed resumes its interest rate cuts. The FOMC is scheduled to meet at the end of July, but the odds of a cut this month are low. The strong June report on jobs at 147K and the rate of unemployment at 4.1% gives the Fed time to keep rates unchanged. Fed Chair Powell has reiterated they are waiting to detect the inflationary effects of the Trump administration’s tariff and international policies. Many economists expect inflation to increase during the summer as businesses seek to pass higher costs on to consumers. Based on the recent comments of committee members, the Fed is divided into two groups: those leaning toward two 0.25% cuts this year and those favoring no cuts.

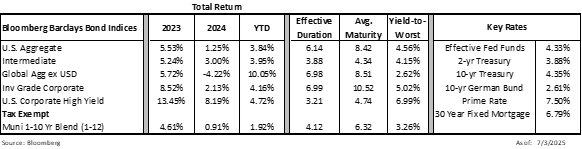

Treasury yields declined this past month as investors wait for the Fed to resume cutting interest rates. We expect the short end of the curve to stay inverted in the near term. Bonds maturing within a year continue to offer attractive yields with lower duration risk, yet we expect this to eventually change. Longer-term Treasuries are likely to remain range-bound but sensitive to inflation data and Fed signals. We continue to maintain an above-benchmark portfolio duration for our bond portfolios. Corporate spreads remain relatively narrow.

The information and material contained herein is provided solely for general information purposes. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.