Diamond Capital Management's Market Commentary

November, 2025

Gavin J. England

Vice President & Senior Portfolio Manager

Executive Summary:

-

Strong Equity Market Performance: U.S. equities continue to advance as the S&P 500, the Dow, and Nasdaq-100 are back to record high territory.

-

Technology and AI Leadership: The technology sector continued to lead, powered by the “Magnificent Seven” stocks.

-

Economic and Policy Shifts: Despite market strength, global economic signals remained fragile underscoring the importance of risk management and diversification.

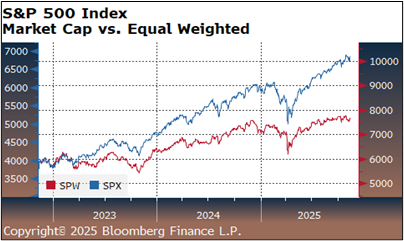

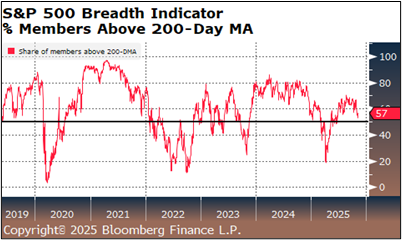

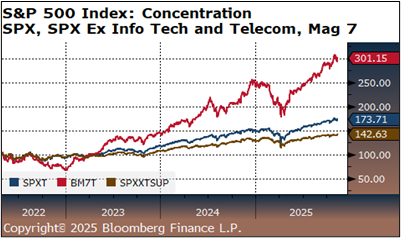

With less than two months to go in 2025, the major U.S. stock indices are approaching another year of double-digit returns. The S&P 500 is up nearly 18%, the Dow Jones Industrial Average is above 14%, and the Nasdaq-100 has surged more than 22%. The ongoing rally has been fueled by robust Q3 earnings, easing U.S.-China trade tensions, and fading concerns about the negative impact of tariffs.  Market breadth narrowed, with large-cap growth stocks outperforming while midcaps and equal-weight indices lagging slightly. While this can raise concern about concentration risk, this factor is less worrisome with all asset classes moving upward. Technology has led the charge, cementing its role as the market’s growth engine. The “Magnificent Seven” collectively represents nearly 40% of the S&P 500 Index’s market cap, helping to drive tech sector gains.

Market breadth narrowed, with large-cap growth stocks outperforming while midcaps and equal-weight indices lagging slightly. While this can raise concern about concentration risk, this factor is less worrisome with all asset classes moving upward. Technology has led the charge, cementing its role as the market’s growth engine. The “Magnificent Seven” collectively represents nearly 40% of the S&P 500 Index’s market cap, helping to drive tech sector gains.

Highlighting the impact of technology and especially Artificial Intelligence on the overall market performance, Apple surpassed a $4 trillion market cap, underscoring investor confidence in its ecosystem.  Microsoft finalized a landmark deal with OpenAI, acquiring a 27% stake and securing long-term access to advanced AI models, reinforcing its leadership in artificial intelligence. Computing chip manufacturer NVIDIA maintained its momentum as AI infrastructure spending accelerated across industries. Overall, the Technology Select Sector has advanced nearly 27% YTD, reflecting a strong investor appetite for innovation-driven growth.

Microsoft finalized a landmark deal with OpenAI, acquiring a 27% stake and securing long-term access to advanced AI models, reinforcing its leadership in artificial intelligence. Computing chip manufacturer NVIDIA maintained its momentum as AI infrastructure spending accelerated across industries. Overall, the Technology Select Sector has advanced nearly 27% YTD, reflecting a strong investor appetite for innovation-driven growth.

However, not all industries and sectors have fared as well as technology and AI.  October showed more evidence of a fragile global economic backdrop: slowing growth, persistent inflation, and mounting debt risks along with geopolitical tensions and structural imbalances. The slowing labor market is a cause for concern although the lack of timely data from government agencies has made accurate economic forecasts difficult. While central banks are pivoting toward easing, policy uncertainty and concentrated sectoral gains (notably in tech) leave markets exposed to sharp corrections. For investors and businesses, risk management and diversification remain paramount.

October showed more evidence of a fragile global economic backdrop: slowing growth, persistent inflation, and mounting debt risks along with geopolitical tensions and structural imbalances. The slowing labor market is a cause for concern although the lack of timely data from government agencies has made accurate economic forecasts difficult. While central banks are pivoting toward easing, policy uncertainty and concentrated sectoral gains (notably in tech) leave markets exposed to sharp corrections. For investors and businesses, risk management and diversification remain paramount.

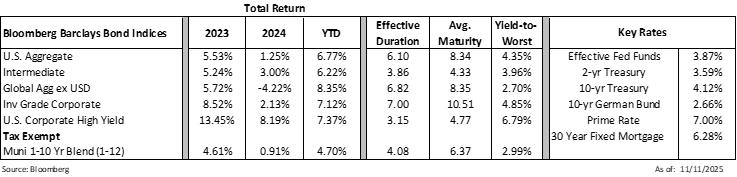

The Federal Reserve delivered its second consecutive rate cut, lowering the federal funds target range by 25 basis points to 3.75%–4.00%. This move, widely anticipated, was aimed at countering a weakening labor market while managing inflation that remains above the 2% target. The Fed also announced it will end quantitative tightening (QT) on December 1, signaling a pivot toward more accommodative policy. Chair Powell emphasized “downside risks to employment” but cautioned that a December cut is not guaranteed.

The information and material contained herein is provided solely for general information purposes. This material is not intended to be investment advice nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.