Deborah Baker, CFP, VP & Senior Financial Planner, Diamond Capital Management

For many of us, each new year brings numerous resolutions, and finances and budgeting are often included among those. Regarding finances, a worthwhile and recommended resolution includes a budgeting process, which is often the first step in a long-term financial plan that can help ensure financial stability and the building of wealth.

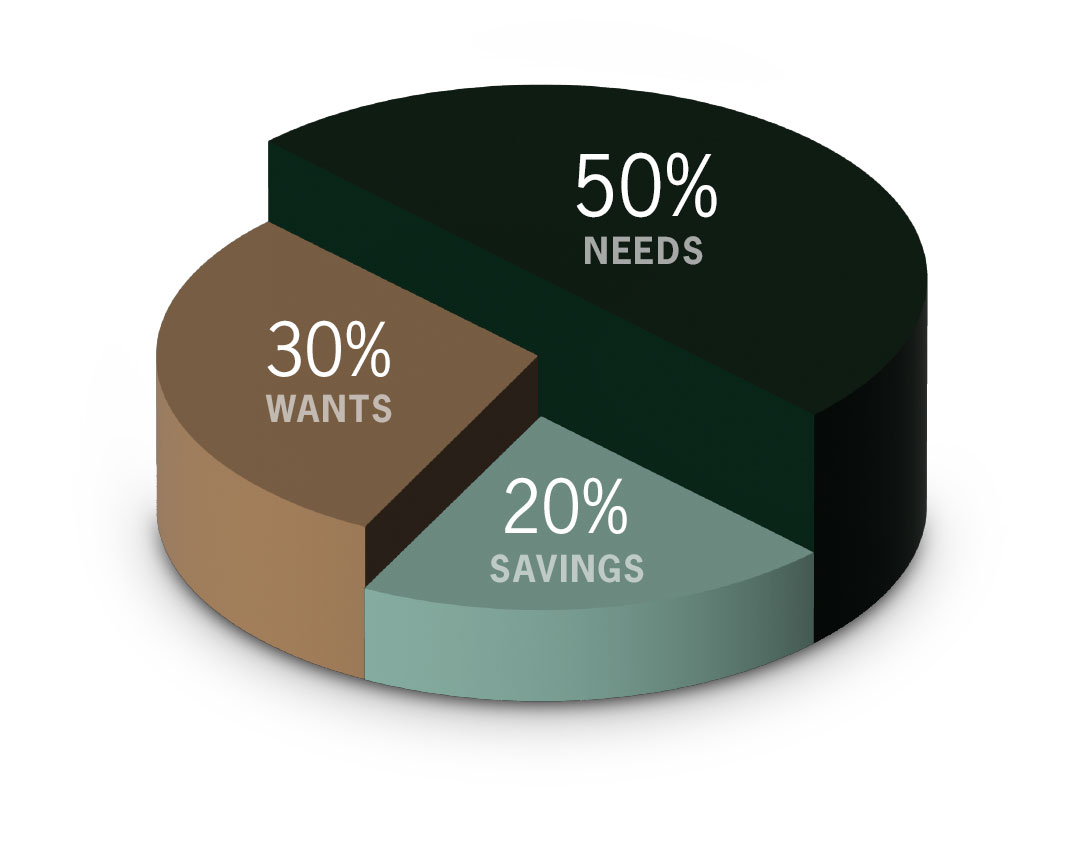

A budgeting tool that is frequently used to jump-start a financial plan is the “50/30/20 Budget Rule.” Allocations used in this rule apply to after-tax income and are detailed below.

Needs:

As you can see, 50% of your take-home pay is devoted to “Needs.” These are vital expenses that should not significantly vary month to month. Housing is included in this category, for which no more than 30% of total income should be allocated. This leaves 20% to cover remaining essentials such as groceries, utilities, clothing, insurance and vehicle costs. If keeping the 30% threshold for housing is not viable, cuts should be made in other areas mentioned above to keep the “Needs” spending at 50%.

Wants:

Thirty percent of take-home pay is allocated to the “Wants” category. Non-essentials are included here, such as entertainment, hobbies and travel. These expenses are discretionary and can change often. If funds from this category are not fully spent, excess funds should be directed to the savings component.

Savings:

Finally, 20% of after-tax income should be directed to “Savings.” While Savings receives the smallest allocated percentage, it is arguably the most important, particularly when saving for retirement and investing.

The components of Savings include:

Emergency Fund

An emergency fund of three to six months' take-home pay should be maintained in a non/low-risk account such as a savings or money market account. While there are many variables to determine how much should be saved, generally six months is needed for a primary breadwinner with a family, particularly if spouse/significant other does not work, or if a current job's salary would be hard to replace. Three months should suffice in situations where a current salary can easily be replaced, or if spouse/partner has a dependable salary. Single self-employed individuals should strive to maintain a fund of six months, and everyone should ensure that insurance deductibles can be covered in the event of various emergencies.

Debt Payments

Avoiding high-interest loans such as revolving debt (credit cards, high-interest car loans) is critical to financial success. Make a concerted effort to pay off such loans as aggressively as possible. There are various strategies employed in paying debt, but a good rule of thumb is to pay down the highest interest loans first and consolidate debt into the lowest-rate loan available. Many ask whether paying down debt is more important than saving for an emergency fund: the best solution is to do both simultaneously.

Retirement

After creating an emergency fund and paying off high-interest debt, start directing funds to a retirement account. For most of us, an Employer Sponsored Retirement Plan (401/k or 403/b) is the simplest route to save for retirement. Start saving/investing as early as possible. Be sure to contribute enough to maximize the employer-matching fund feature if available in your plan - this is free money – but strive to contribute the maximum allowable to your account. And, use a percentage of your income instead of a dollar amount when saving for retirement; this keeps your savings rate relative to your earnings. If Employer Sponsored Plans are not available, open an Individual Retirement Account; Roth options are great for employees who are eligible to contribute based on income levels.

Investing

Investing creates wealth by providing opportunities in the market to earn higher returns in exchange for taking reasonable risks, whether in advisory accounts or retirement accounts (since most Employer Sponsored Plans and IRAs offer investment choices). Investing requires a long-term commitment and means routinely depositing money into accounts. Use automatic deductions for these additions; it is much harder to miss what you do not see. Younger investors can and should be more aggressive with investments, with allocations becoming more conservative with age.

When used steadily, the Budget Rule technique discussed above can help ensure the creation of wealth because it provides for consistent investing over time: time in the market is the most important factor in building wealth due to the power of compounding funds over years. This compounding effect has been described as “the principle of reaping huge rewards from a series of small, smart choices.”

As funds accumulate in retirement and investment accounts, it becomes time to collaborate with a financial advisor and/or a financial planner. These professionals can advise on appropriate accounts, investments, allocations and routinely monitor investments based on current financial conditions. Our specialists at Diamond Capital Management and The National Bank of Indianapolis are such professionals and assist clients with investment and financial planning needs, working with you to achieve investment and lifetime goals.