The Miracle of Compounding Interest

By Andy Newell

Assistant Vice President & Investment Officer

Called the eighth wonder of the world, compound interest is a potent phenomenon, and understanding how to take advantage of it is critical to one’s own financial well-being.

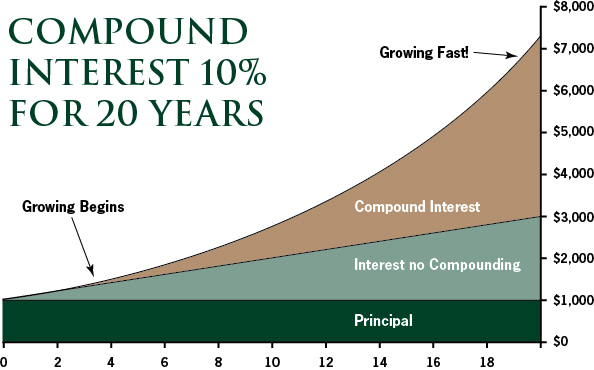

Interest is the additional amount our money earns when it is on deposit at a bank. It is also the money we pay when we borrow in the form of loans or credit cards. Whereas simple interest is money earned (or paid) solely on the principal deposited or lent, compound interest is earned not only on the principal but also on previously earned interest.

The potency of compound interest is why it is so highly regarded. At first, your money makes money, and then that money makes even more money. This “compounding” of interest is exponential: the amount of interest earned accelerates as more interest accumulates. For instance, interest earned on a savings account, such as a Capitol Money Market Savings account at The National Bank of Indianapolis, is deposited back into the account, providing a larger balance from which your next interest deposit will be calculated. Ultimately, it requires no investing expertise, only patience and discipline.

Famed investor Warren Buffett, who recently retired as CEO of Berkshire Hathaway, once said, “My life has been a product of compound interest. Nothing more. Nothing less. And nothing brilliant.”

To best take advantage of compound interest, start saving early. That compounding effect takes place over time, so the more time you have, the more growth you will see. Making consistent, even if modest, contributions to your savings will also continue to accelerate that growth.

Be aware that compounding interest cuts both ways. Interest on credit card debt, for example, will compound. Past interest charged will be capitalized and added to the principal debt, resulting in even more interest you pay in the future. Again, discipline is key, this time in our spending habits. Additionally, entering debt with an exit plan is prudent. Loans can be a valuable tool to accomplish your financial goals. However, just like your investments, they need to be monitored and managed.

The ability to effectively harness compound interest will have significant effects on our long-term financial health. Whether saving for retirement, education, or any other reason, compound interest is a consistent and reliable investing tool. The earlier you begin, the greater your results. Please contact us at The Bank to learn more: www.nbofi.com/wealth-management.

The information and material contained herein are provided solely for general information purposes. This material is not intended to be investment advice, nor is this information intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only current as of the stated date of their issue. Certain sections of this publication contain forward-looking statements that are based on the reasonable expectations, estimates, projections, and assumptions of the authors, but forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investment ideas and strategies presented may not be suitable for all investors. No responsibility or liability is assumed by The National Bank of Indianapolis, or its affiliates for any loss that may directly or indirectly result from use of information, commentary, or opinions in this publication by you or any other person.